Focused on the Evolution of Adaptive Correlation

Defined processes typically deliver better outcomes. "If you can't describe what you are doing as a process, you don't know what you're doing" - W. Edwards Deming

We incorporate computer modeling to enable defined processes to know how to adapt to changing conditions; enhancing performance metrics. Adaptive Investment Research seeks to discover investment processes that typically correlate to broad market benchmarks in up markets, but adjust to mitigate risk; reducing correlation in down markets. Our methodologies are unique and diversified including AI / Pattern Recognition, Economics, Momentum / Trend Followiing, Option Overlay, and Fundamental Valuation.

Simply put: we seek to enhance performance in up markets by playing offense, and reduce losses in down markets by playing defense.

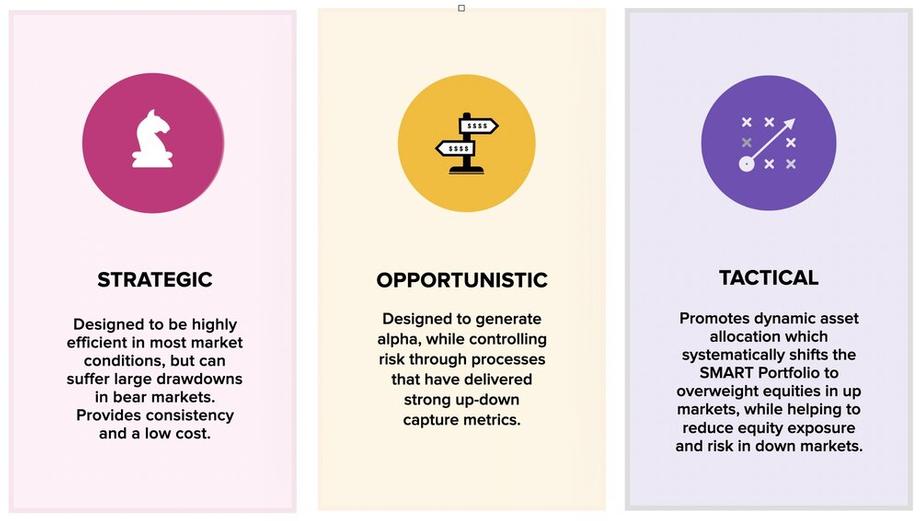

A Smart Portfolio is designed to deliver better results over all market conditions. Passive/strategic investing has generally performed well in most markets, but have been vulnerable to losses in bear markets; thus, at times, experiencing harsh drawdowns.

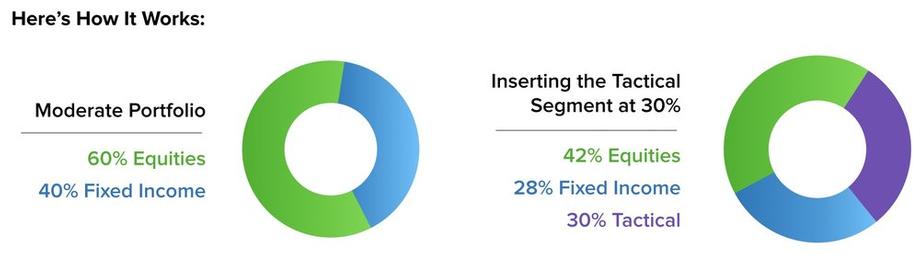

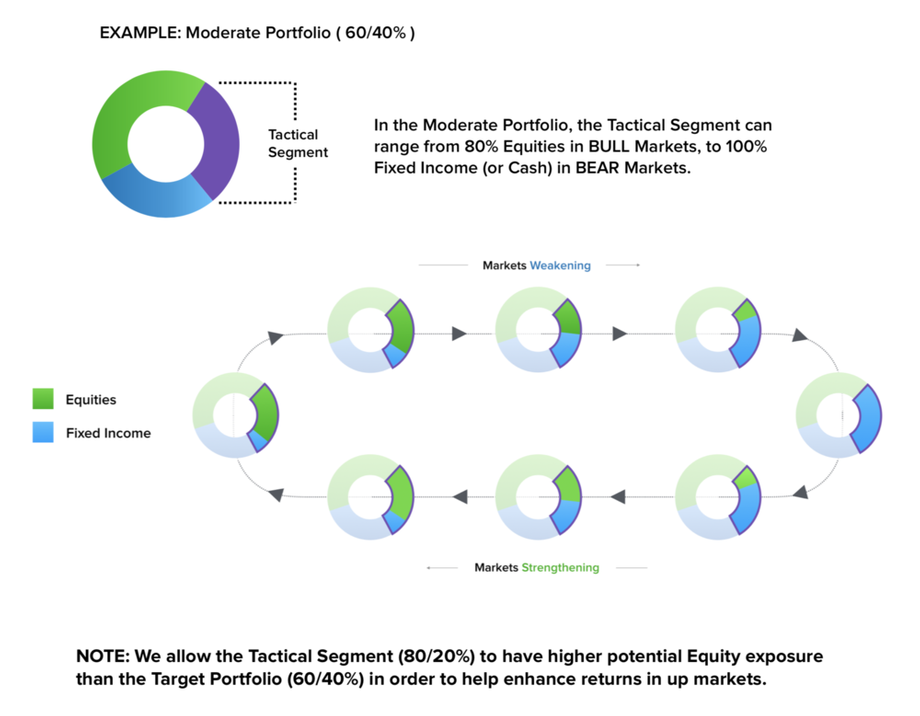

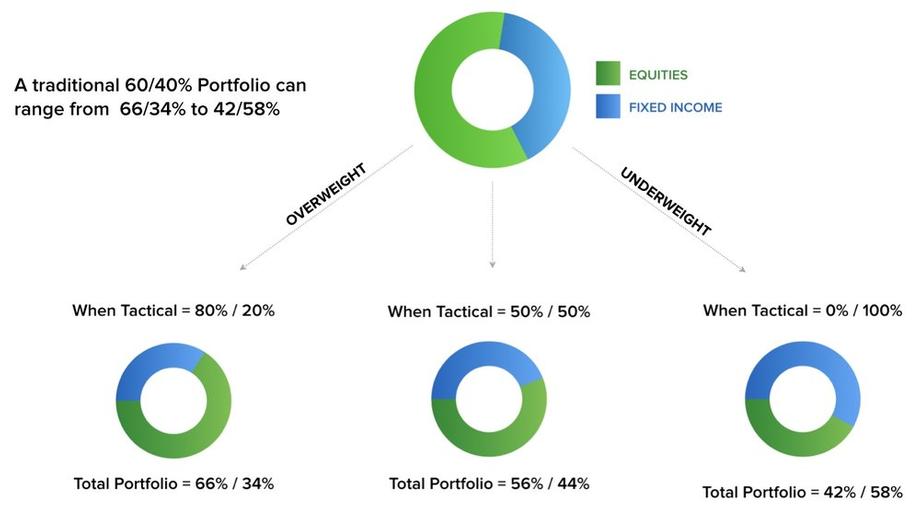

A Smart Portfolio is Dynamic

The tactical segment positions the portfolio to overweight equities in up markets while underweighting equities in down markets.

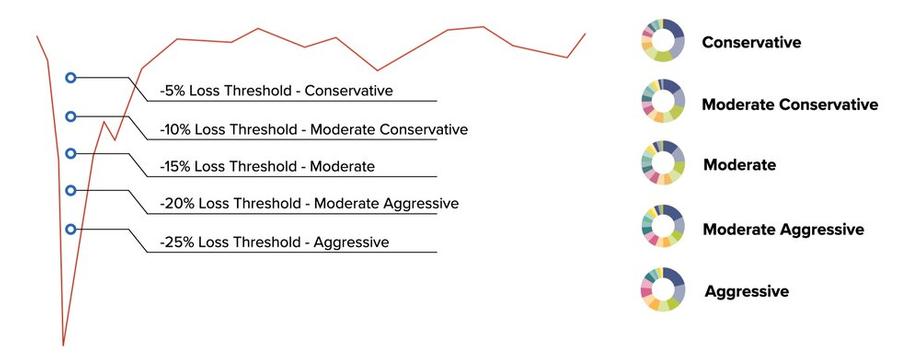

Portfolios are optimally structured based on risk tolerance and loss threshold designed to meet specific client objectives. Portfolios are designed to minimize the changes that the portfilio will breach its drawdown threshold in bear markets:

Loss Threshold By Drawdown: